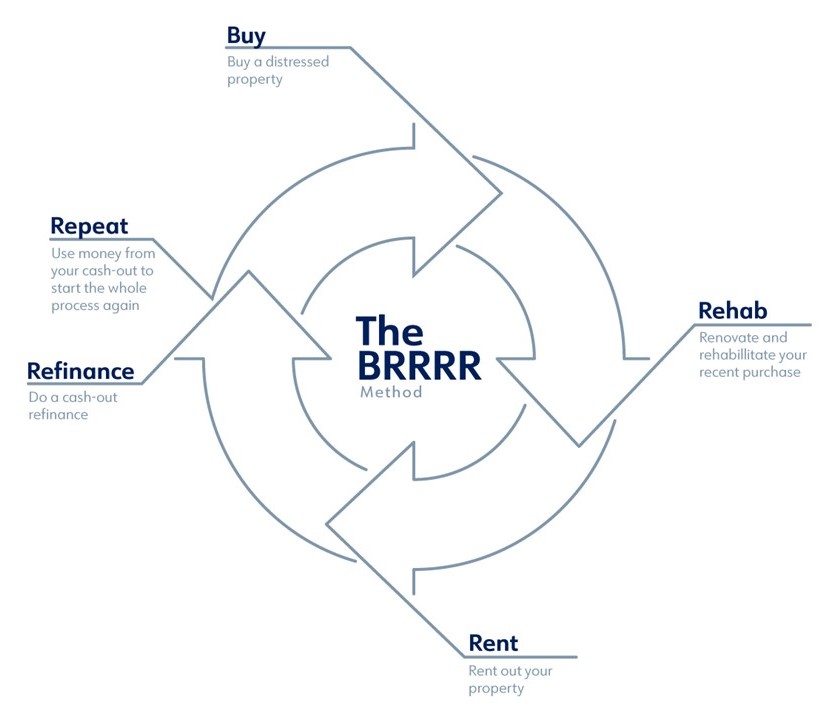

BRRRR strategy can provide passive income and a revolving method for purchasing and owning rental property. The method works through the following steps: Buy a property: The property you purchase should be a distressed property that needs some work to get […]

read more

Buying Investment Properties

Questions to Ask Before Hiring a Property Manager

Are you thinking of hiring a property management company? Then you need to ask the right kind of questions. With the right questions, you stand a high chance of selecting an efficient, effective and reputable property management company. Here are […]

read more

read more

Why Consider A 1031 Tax Exchange?

When you are selling an investment property can be subject to taxation. Those taxes can add up quickly depending on the type of property, how long it was owned, state taxes, capital gains, depreciation and the owner’s tax bracket. As […]

read more

read more

5 Things You Should Know Before Investing in a Turnkey Property

What is Turnkey Investing? At its core, turnkey real estate investing is where you buy already rehabbed, tenant-filled, managed properties that are producing positive cash flow. A lot of the extra work that goes into real estate investing is cut […]

read more

read more

Fannie Mae Reserve Requirements for Investors with Multiple Properties Owned

What Are Reserves? Reserves are liquid or near liquid assets that are available to a borrower after the mortgage closes. On every loan transaction, reserves are required to be verified as part of the approval process. Acceptable sources or reserves […]

read more

read more

Thing You Need to Know About a 1031 Tax Exchange

The identification period in an IRC Section 1031 delayed exchange begins on the date the taxpayer transfers the relinquished property and ends at midnight on the 45th calendar day thereafter. To qualify for a 1031 tax-deferred exchange, the tax code […]

read more

read more

Majority of Renters Plan to Stand Pat

Rents may be rising and consumers may be feeling the crunch when it comes to their personal finances, but 70 percent of renters still believe that renting is more affordable than owning a home and 55 percent of renters plan […]

read more

read more